Valletta Boutique Living, better known as VBL Group, has announced that it will be offering shares to the public for the first time in an Initial Public Offering (IPO).

The company, which is the largest private owner of real estate in Valletta, will be issuing over 35 million new shares, while existing shareholders will also be offering the same amount of shares if the new shares are subscribed in full.

VBL plc on Tuesday issued a formal notice announcing the offer of:

• 35,714,286 new shares, representing 12.6 per cent of the total issued share capital of VBL post-IPO, to be admitted to the Official List of the Malta Stock Exchange; and

• 35,714,286 shares to be sold by existing shareholders subject to the new shares being subscribed in full.

The offer price for this initial public offering is set at €0.28 per share and is open for subscription to all categories of investors, subject to a minimum subscription amount of 10,000 shares (equivalent to €2,800) and in multiples of 100 shares thereafter.

The offer period will run from 2nd August until 24th September (or earlier in the case of oversubscription).

The shares of VBL are expected to be admitted to the Official List of the Malta Stock Exchange on 12 October and trading is expected to commence on 13th October.

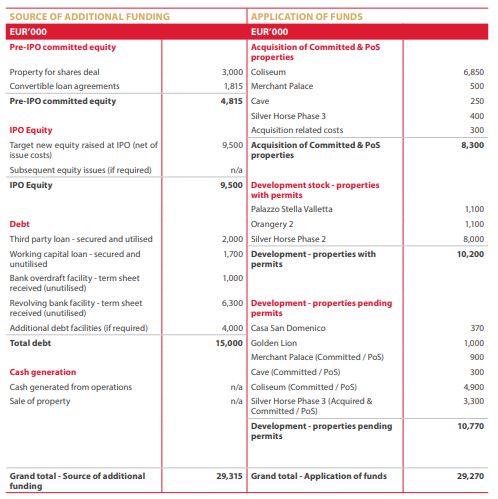

The net proceeds from the new shares, which are expected to amount to up to €9.5 million, will form part of a wider long-term funding and investment plan of VBL that is aimed at funding the strategic development plans of the group.

A breakdown of the sources and application of funds for the group is provided below:

The Company is involved in the real estate industry, with a niche focus on identifying, acquiring, developing and managing real estate in Valletta.

The Group’s strategy involves creating a diverse portfolio of operational and development assets, consisting of hospitality (accommodation) assets, for both short and long-term lets and commercial real estate, consisting of retail, entertainment and office space.

Dr Andrei Imbroll, co-founder and chairman of VBL Group, has been vocal about his long term vision for the capital, even raising the possibility of 'bringing back' Valletta's historical neighbourhoods.

The Company currently holds 100 per cent of the issued share capital in the following operating subsidiaries:

i. VREM Ltd: VREM Ltd is entrusted with the hospitality and property operations within the Group. VREM Ltd manages and operates the assets of the Company and provides property management services for third-parties;

ii. Silver Horse Block Ltd: Silver Horse Block Ltd was established for the purpose of acting as the dedicated project development of the single largest mixed-use development project in Valletta, known as the “Silver Horse Phase 2” project; and

iii. Casa Rooms Ltd: Casa Rooms Ltd was acquired by the Company in January 2021, and is a property management business, focusing on real estate management and long- and short-lets across Malta. Casa Rooms Ltd is a recognised hospitality services provider in Malta, with 115 properties under management, 30 of which are situated in Valletta

The sponsor, manager and registrar for the offering is Rizzo Farrugia & Co (Stockbrokers) Ltd. The prospectus can be found on their website here.

Main Image: