Leading stockbroker Edward Rizzo warned that developments at MIDI plc and Malita Investments plc “continue to destroy the credibility” of Malta’s equity market.

In his weekly column on BusinessNow.mt, Mr Rizzo cast a look at the state of the Maltese equity market in 2025 and warned that there is a general state of disgruntlement among various cohorts of investors.

He noted that trading volumes in several local equities have declined significantly compared to a few years ago, while company announcements often fail to elicit a market response.

In fact, BOV alone amounted to a massive 44 per cent of all equity trading activity over 2025, with just over €21.6 million worth of shares changing hands.

Mr Rizzo said this sentiment of disgruntlement was aggravated by the sudden dips of two local equities - MIDI plc and Malita Investments plc.

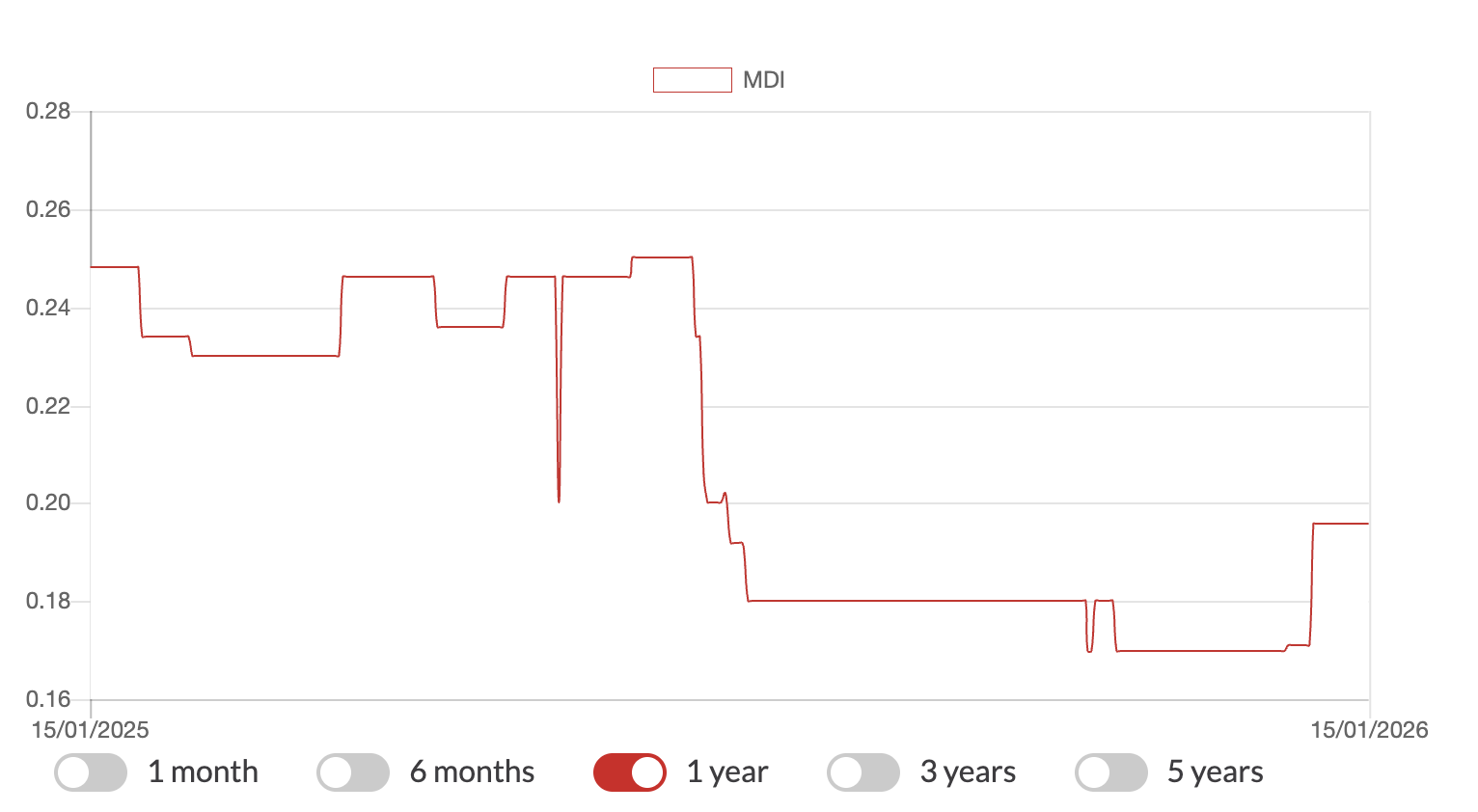

MIDI plunged by around 28 per cent in July 2025 as the consortium’s planned Manoel Island development faced intense national criticism.

This culminated in Prime Minister Robert Abela announcing that he will scrap the proposed development and turn the island into a national park instead.

After shares in MIDI plunged to a ten-year low, they have only slightly recovered their value.

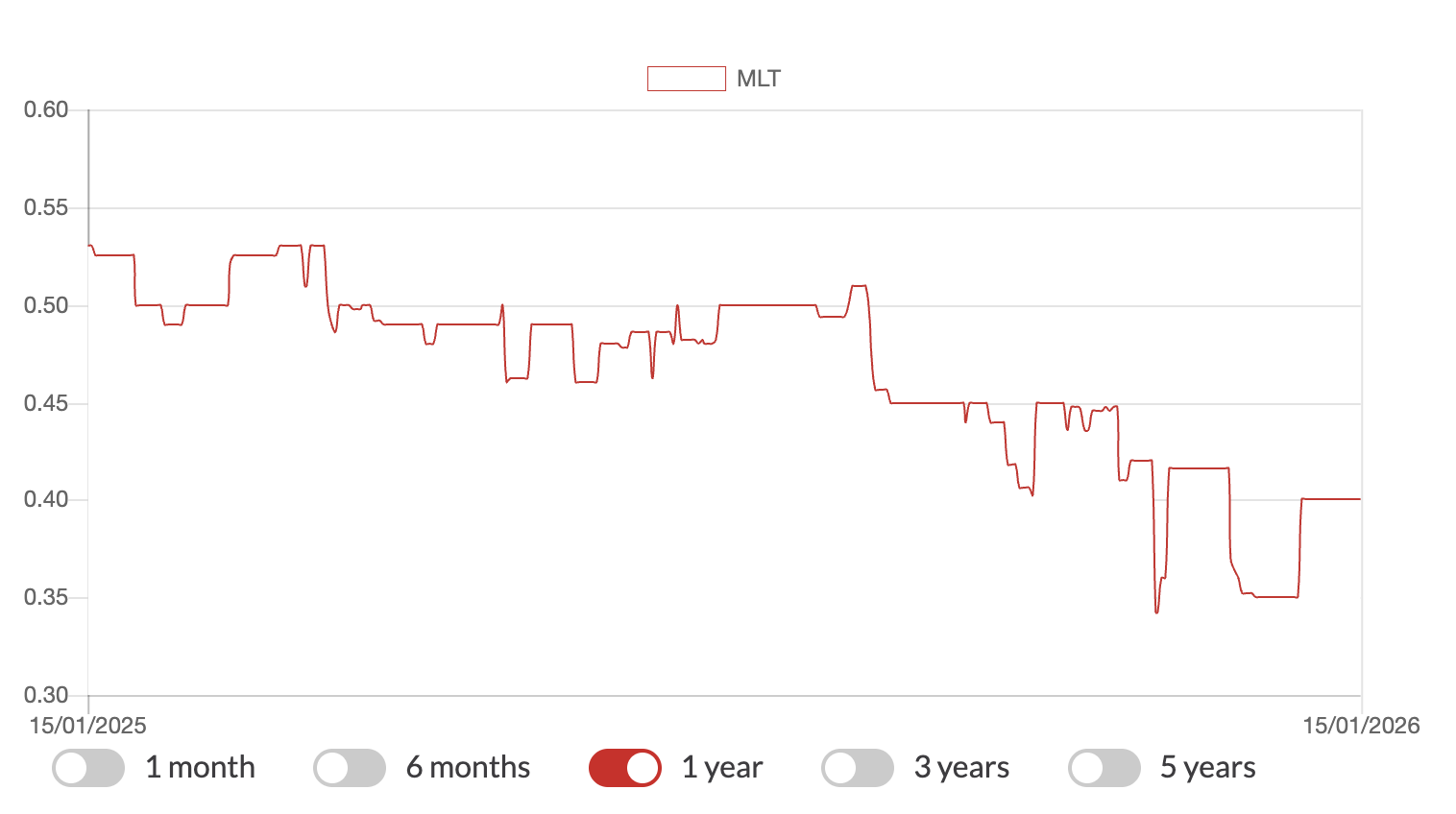

Meanwhile, Malita dropped by around 18 per cent in November following a Times of Malta report that it failed to pay a contractor some €1.1 million for works on a social housing project.

Malita’s chairperson Marlene Mizzi later claimed she was removed from her post after objecting to interference by Housing Minister Roderick Galdes, an accusation Galdes denied.

The company has since recovered most of its value.

“Despite a number of important block trades over 2025 and the general positive financial performances reported by a number of companies, it is difficult to expect overall sentiment to improve materially,” Mr Rizzo said.

“Unfortunately, the hugely disappointing ongoing developments at MIDI plc and Malita Investments plc are undoubtedly continuing to destroy credibility of the equity market.”

He predicted that capital flight will continue as equity-oriented investors “understandably” move their investments to international markets.