Bank of Valletta plc (BOV) and APS Bank plc have both encouraged their customers to stay vigilant and wary of possible scam attempts sent through different platforms.

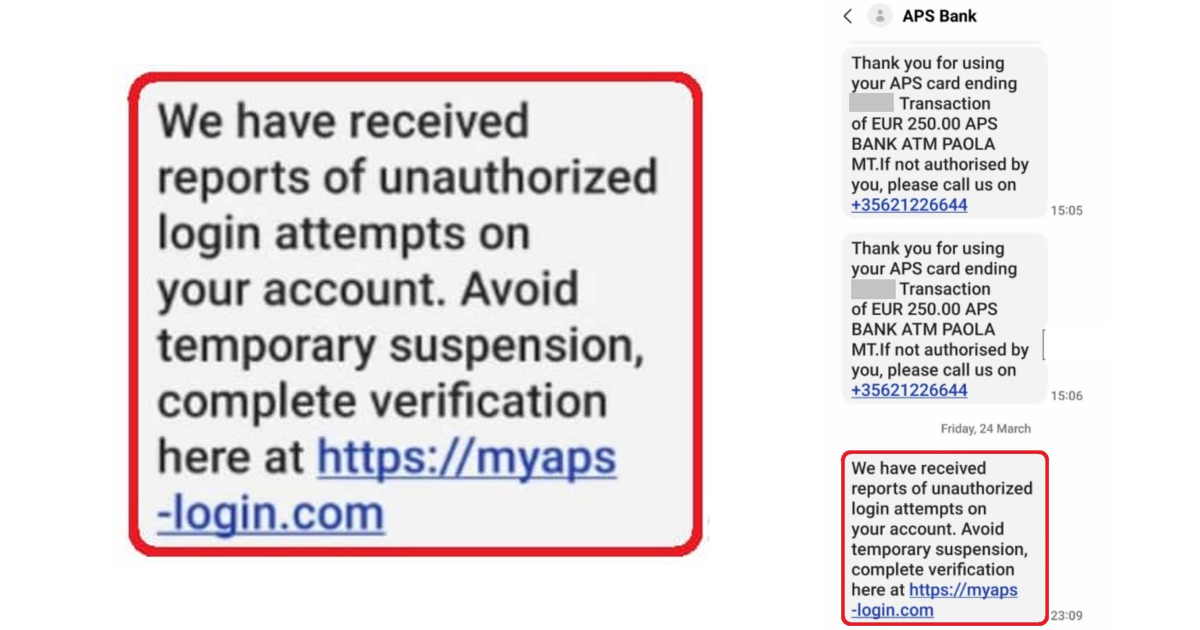

APS Bank released a statement on Saturday saying that it has received reports of scamming through SMS, also known as “smishing”, with some customers receiving messages that “appear to be from the bank”.

An example of a scam attempt that APS Bank pointed out / APS Bank plc

Similarly, BOV on Monday urged customers to be “vigilant and alert” in order to spot “various scams” that are being circulated locally, as in some cases, such scams even encourage them to “carry out fraudulent financial transactions”.

“Some scams typically involve sending fake text messages that seem to originate from a legitimate financial institution. These messages usually contain links leading to a fake website, where victims are prompted to give out sensitive information. Once such information is given out, the fraudsters will have access to account details and passwords, and then be able to conduct fraudulent transactions from customers’ accounts,” BOV explained.

BOV added that one of the tricks involves fraudsters informing victims that their card or phone has been blocked for security reasons, inviting them to click on a link to a fake website. In other occasions, such scams can be done over the phone, by fraudsters disguised as “genuine employees”.

“Do not provide any details, reply to, click on the link, or take any action”, APS instructed customers.

“We will never request a password change, your personal details, or execute transactions by SMS, email or social media,” it continued.

BOV reiterated this, adding that any phone calls made by its employees “will not ask for specific account or card numbers in full, card CVV details, card pins, internet or mobile banking passwords, codes, signatures, one-time passwords, or multi-factor authentication”. “Bank employees will never ask customers to divulge information that leads them to conduct financial transactions over the phone,” BOV explained.

Additionally, BOV said that it has a card fraud management team that monitors suspicious transactions on card activity “round the clock, contacting customers whenever necessary to verify transactions occurring on their accounts” and to also take “remedial action when the customer does not recognise transactions”. It has also invested in technology that monitors card transactions in real time, thereby “helping to identify and stop” suspicious transactions as they occur.

It added that has just launched a campaign titled “Spot the Scam”, through which it will be sharing tips and tricks to recognise and avoid fraudulent activities such as “spoofing, phishing emails, fake phone calls, and identity theft”.

“Customers are urged not to trust any sites that are not official and to think twice before clicking on links or giving out information,” BOV concluded.

Main Image: