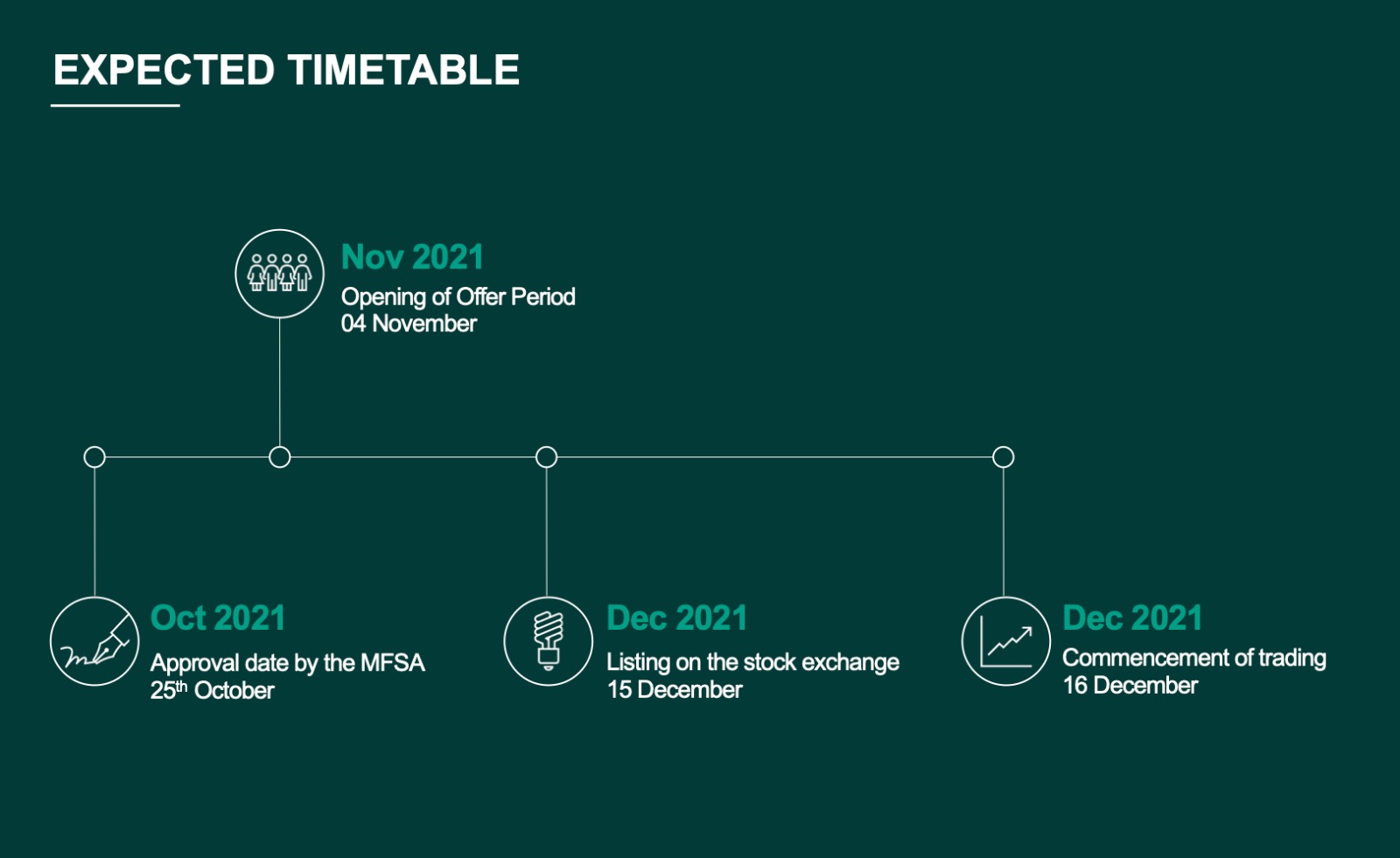

Hili Properties Company plc is gearing up for its upcoming Initial Public Offering (IPO), which is expected to see it issue 185,185,185 shares at €0.27 each, with a total value of €50 million.

The company expects regulatory approval of its prospectus for this IPO to be received by 25th October 2021.

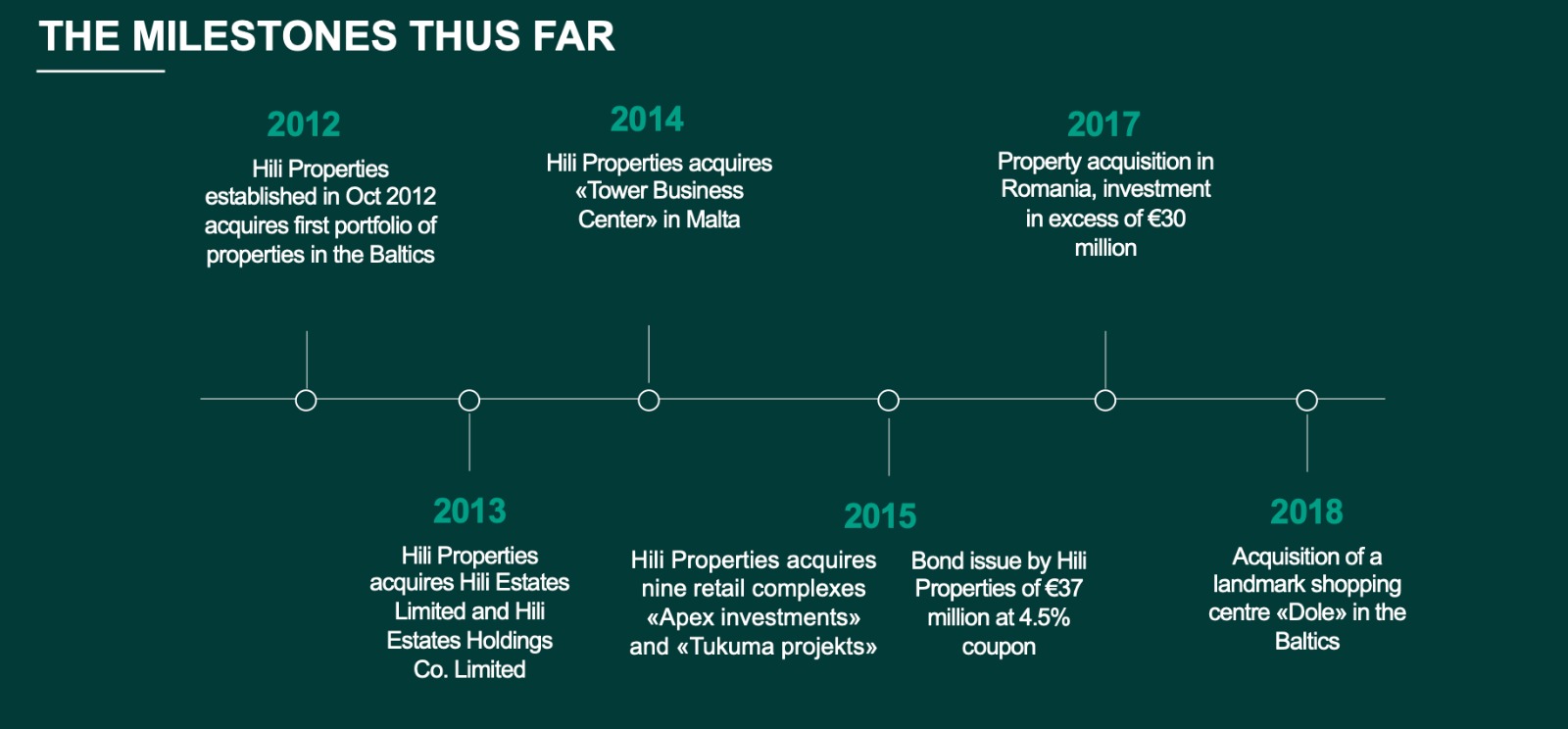

A brief history of Hili Properties

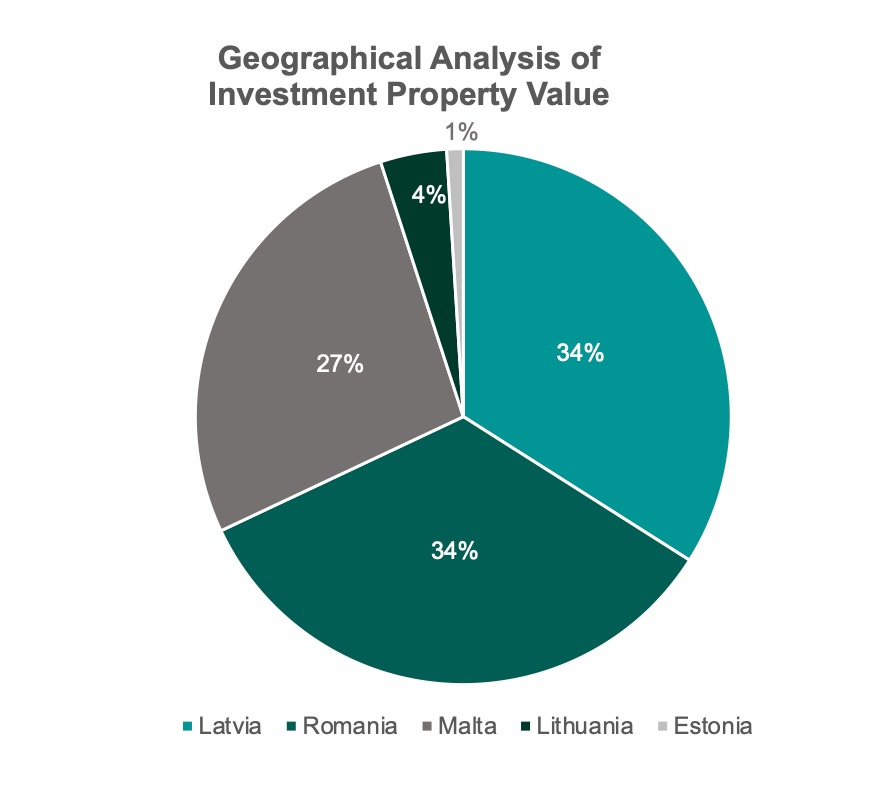

Hili Properties owns and manages strategic commercial real estate for lease in the Baltics (Estonia, Latvia and Lithuania), as well as Malta and Romania, with a total value of more than €115 million.

A geographic breakdown of Hili Group's properties. Image: Hili Properties

Its portfolio consists of dedicated business blocks and office space, grocery-anchored shopping centres, healthcare facilities, and properties housing McDonald’s restaurants in key commercial districts.

Its stated strategy is focused on providing “attractive, risk-adjusted total returns to shareholders” derived from stable yield supported by its current portfolio’s long-term contracted cash flows and income growth that is embedded in its current portfolio through contractual rent escalations.

The group says it actively pursues acquisitions through newly identified assets, and asset value appreciation through continuous management and upkeep of its properties.

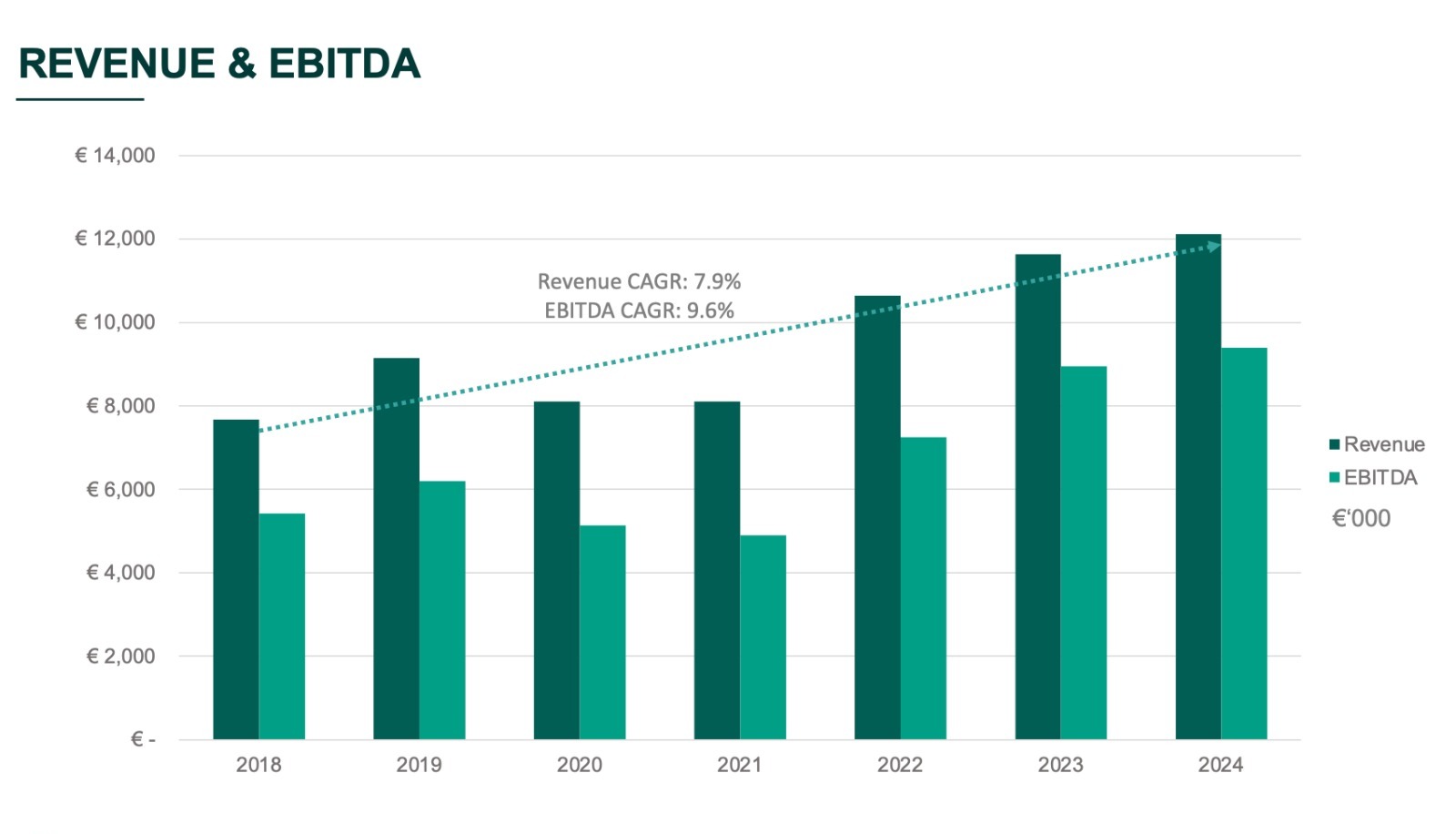

Hili Properties' historic and projected revenue and earnings before interest, taxes, depreciation and amortisation. Image: Hili Properties

Hili Properties seeks to achieve these objectives through the performance of its current portfolio, driven by proactive portfolio management, maintaining a prudent capital structure, implementing corporate governance framework aligned with best market practices.

To execute its strategy, the company says it leverages on its on-ground professional management team with “industry expertise and a track record of value creation.”

In terms of financial results, the group made €5.2 million in registered profits before tax during 2020 and had a portfolio size of €115.6 million as of the end of August 2021.

Altogether, it has 75,466 metres squared of rentable area, with an average occupancy of 99 per cent and a lease term of 8.8 years.

Some of Hili's prominent tenants. Image: Hili Properties

Looking to the future, the group is in “advanced discussions” to acquire one commercial property in Poland and one industrial property in Lithuania, having a combined value in excess of €38 million.

Highlights of the Poland property include its strategic location, on one of the main exit arteries of Warsaw, a yield of approximately seven per cent, a long lease duration of nine years (and additional extension options), and that it is a newly reconstructed property.

The Lithuania property is in a “strategic location,” with “excellent” access to key cargo routes, and has a strong international tenant.

It has a 20-year lease agreement with a single tenant, and an occupancy of approximately 100 per cent.

Through its “extensive” network of relationships, it sources investment opportunities, and is currently negotiating the price for the acquisition of additional commercial assets.

The group is also currently in discussions with buyers to sell three of its commercial properties.

Regarding its dividend policy, the company is expected to generate a strong cash flow over the forthcoming years, with long-term lease contracts in place, allowing it to adopt a generous dividend distribution policy, set to distribute a four per cent net dividend based on the offering price of €0.27.

A timetable of Hili's IPO. Image: Hili Properties

The company’s full prospectus can be found online.

Main Image: