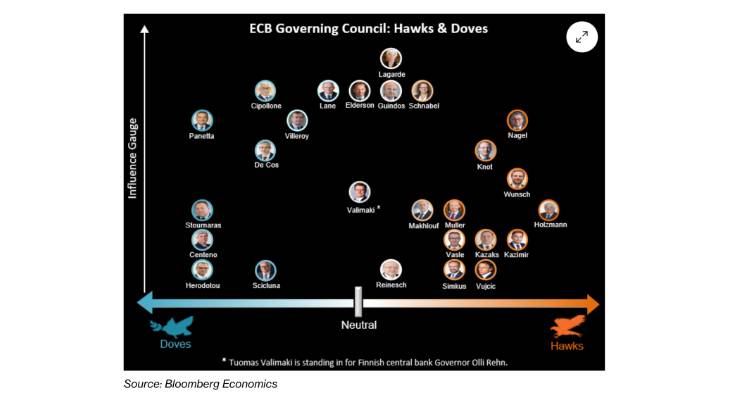

Malta’s representative on the European Central Bank’s Governing Council has been ranked among those least influential in a chart prepared by the major international business publication Bloomberg, which places each ECB Governor and Executive on a scale showing their respective influence and where they stand on the question of monetary policy.

Edward Scicluna, the Governor of the Central Bank of Malta, lies towards the bottom of the gauge of influence used by Bloomberg, in the eighth of eight rows, alongside four others.

These are Boris Vujčić, Governor of the Central Bank of Croatia, Constantinos Herodotou, Governor of the Central Bank of Cyprus, Gediminas Šimkus, Governor of the Central Bank of Lithuania, and Gaston Reinesch, Governor of the Central Bank of Luxembourg.

Croatia, Cyrus, Lithuania and Luxembourg, together with Malta, are relatively small economies, indicating a link between each Governor’s influence and the size of the economy they represent.

In line with the Maltese Government’s prioritisation of economic growth over controlling inflation, Prof. Scicluna is seen as a ‘dove’ on inflation, indication a preference for looser monetary policy and lower interest rates to stimulate economic activity.

The dividing line between the doves and the hawks is also geographic. The Governors of the central banks of Malta, Cyprus, Portugal, Greece, Spain, Italy and France – in a word, the eurozone’s southern states – all prefer to keep interest rates relatively low.

On the other hand, those of Germany, Belgium, the Netherlands, Austria, Slovakia, Estonia and other northern states all advocate keeping interest rates high to bring inflation thoroughly under control, even at the expense of some economic growth.

All eyes are on the ECB this year to see whether it will cut interest rates, after having raised them to record high levels last year in response to high inflation across the bloc.

The announcement late last week that it will not be changing any rate for the time being left investors guessing as to its next moves, as it did not indicate its intentions for the coming months.

However, ECB Chairperson Christine Lagarde hinted that rate cuts may be on the menu by summer, while stressing that the organisation remains data-focused and will react accordingly to economic developments.

In comments made in response to the article, Prof. Scicluna tells WhosWho.mt that the Bloomberg graphic amounts to “pure speculation” simply based on the assumption that big countries are more influential than small ones.

“In the Governing Council, this is certainly not the case,” he says. “Each country has a vote, each country speaks and each country is listened to, and I can assure you that influence is not correlated with size.”

Rather, the voices that tend to convince are those “whose arguments are the most correct, and who are able to present them with a certain fluid and clear logic.”

Prof. Scicluna said the Bloomberg graphic is an attempt by the publication to determine the next steps of the ECB, but ultimately betrays its own lack of insight into what really goes on behind the ECB’s closed doors.

He said that this lack of genuine insight is especially glaring when seeing the names of those on the lowest tier of influence, with one name in particular being “one of the biggest influencers” on the Governing Council.

“It’s all just speculation,” he concludes.

Main Image: