AX Real Estate p.l.c., a subsidiary of one of Malta’s leading businesses, AX Group, is promising investors in its Initial Public Offering (IPO) a minimum gross dividend yield of 6.4 per cent.

The guarantee was made in a presentation about the company’s assets, valuation, and investment potential.

AX Real Estate is seeking to raise new capital and debt in order to finance two key development projects for which permits were obtained in 2021.

These projects are expected to be a major driver of the company’s future growth.

The Verdala Hotel site and the Suncrest site are the sites of two major projects to be developed over the next three years. Both projects have been designed to be developed to “the highest standards synonymous with the AX Group”, the company said.

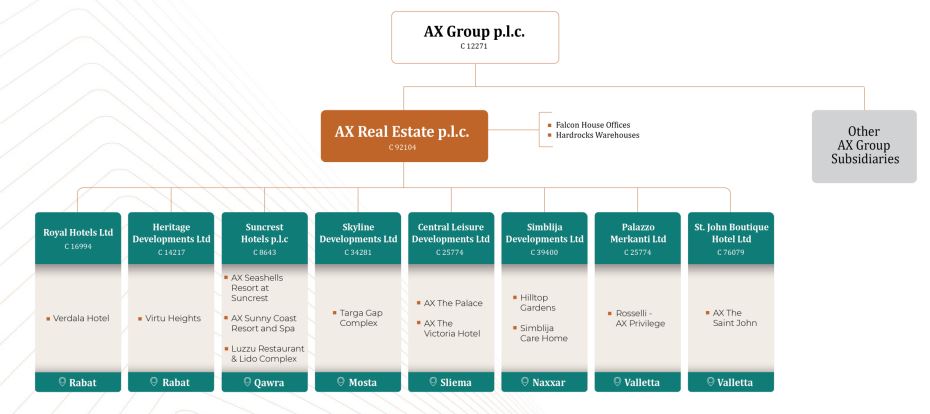

AX Real Estate was formed in 2019, while in 2021 a reorganisation of AX Group was undertaken with a view towards consolidating the ownership of a number of AX Group subsidiaries under one intermediate asset holding company, being AX Real Estate plc.

These subsidiaries own immoveable properties consisting in hotels, a retirement village, and a residential and a commercial properties within the AX Group. The operations of the hospitality and healthcare offerings are managed by specific specialised companies within AX Group not forming part of the AX Real Estate.

AX Real Estate plc owns a portfolio of established, well known properties in Malta that have been recently developed or refurbished.

All these properties benefit from steady revenue streams which emanates both from AX Group operating companies and third-party clients

AX Real Estate will be inviting interested parties to subscribe to a new share issue of €20 million (subject to an over-allotment option of €10 million) and €40 million in unsecured bonds with the proceeds to be channelled towards funding the investment in the Verdala and Suncrest projects, as well as partly refinancing intragroup debt owing to AX Group.

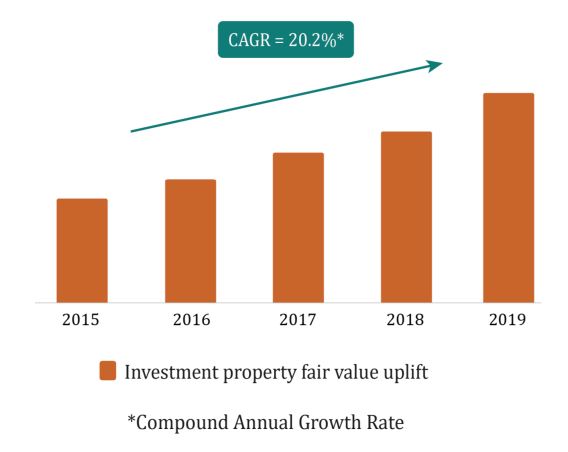

In the period between FY15 and FY19, the fair value of the Company’s key properties (within the Hospitality sector) increased by an average of 20.2 per cent per annum.

This suggests that the value of every €1 invested in AX Group's property portfolio more than doubled in value by the end of FY19 largely through property appreciation.

Shareholders in AX Real Estate plc would be receiving steady dividends in line with the dividend policy and will also be participating in the returns from the appreciation of the Company’s property portfolio.

The dividend policy is based on the distribution of the majority of the annual distributable profits generated by the Group, provided that a minimum balance of €1 million in cash is retained within the Estates Group at any given time.

AX Real Estate plc is committing to a guaranteed minimum gross dividend yield of 6.4 per cent in the first two years.

Upon the lapse of two years, by which time the proposed projects mentioned above should have been completed, projections show a sustainable and strong dividend distribution higher than the initial two years.

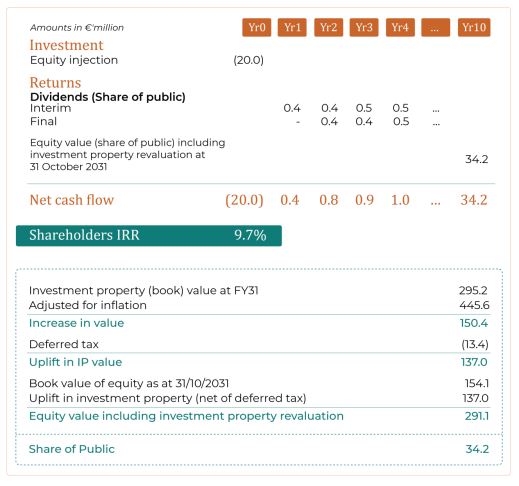

Notwithstanding the historical value uplifts in key hospitality assets, for illustrative purposes a prudent growth of 4 per cent was forecasted. On this basis, the assumed uplift in the property value is estimated at €137m in FY31 (net of deferred tax).

Taking into consideration this return (over and above the dividend stream) would result in a Shareholders IRR (share of public) of 9.7 per cent p.a. over the period, based on an investment of €20m.

AX Real Estate p.l.c. will be offering to the general public: A fresh issue of 33,333,333 ordinary ‘A’ shares of a nominal value of €0.125 per share at an Offer Price of €0.60 per share, subject to an over-allotment option which, if exercised, would increase the offer up to an aggregate of 50,000,000 ordinary ‘A’ shares.

Proceeds raised from both issues shall be deployed as follows:

- €25.6m will be applied to part-finance the Suncrest extension;

- €10m will be applied to part-finance the Verdala Project;

- €14.4m will be utilised for general corporate funding; and

- €8.7m (€18.5m in case the over-allotment option is exercised) shall be used to pay part of the AX Group loan.

- The minimum subscription is set at 5,000 ordinary 'A' shares having a nominal value of €0.125 and €2,000 for the bond issue.

Investors will be guaranteed a minimum allocation of €6,000 in the bond but can subscribe for higher amounts.

Bond issue applications unaccompanied by equity applications will only be considered if the bond application is for a minimum of €250,000.

Equity investors applying for in excess of 200,000 ordinary ‘A’ shares will benefit from a discount of 10 per cent on the offer price.

Preference in allocation will be given to current bond holders of AX Group plc. and AX Investment plc.

The allocation in full of the share offer would result in 25 per cent of the Ordinary 'A' shares of the company being held by the general public. An unsecured bond Issue of €40,000,000 - 3.5 per cent redeemable in 2032.

Main Image: