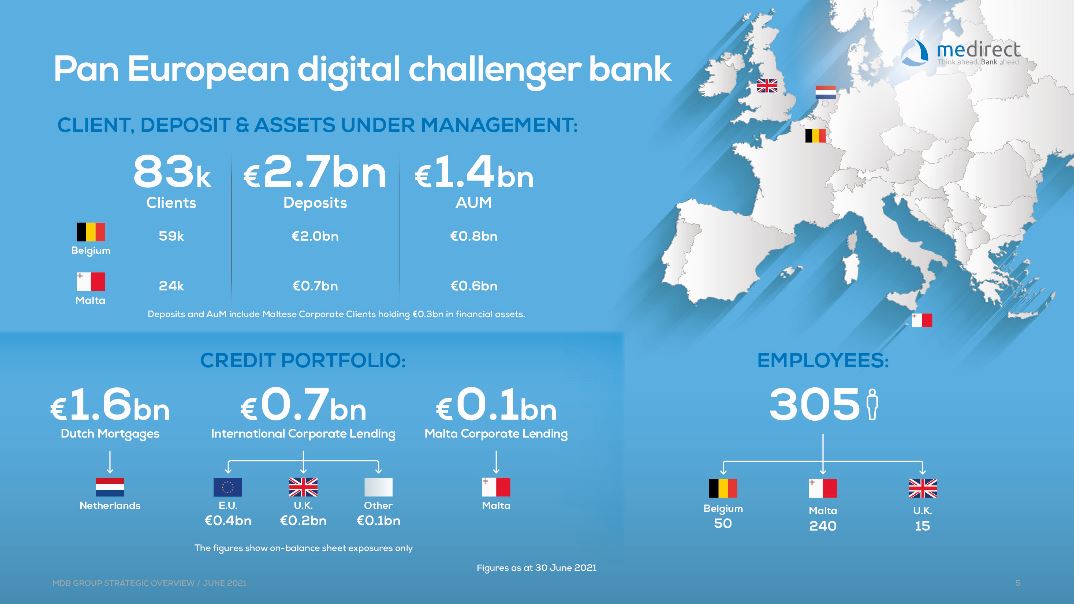

Over the past 12 months, MeDirect total clients in Belgium and Malta increased by 15 per cent to 83,000, leading to a 31 per cent increase in assets under management with an all-time high of €0.8 billion (increasing 44 per cent) in Belgium and €0.6 billion (increasing 18 per cent) in Malta, It has reported.

Over the past year, the Dutch residential mortgage origination volumes grew by €1.0 billion (increasing 168 per cent) and corporate lending in Malta increased by 25 per cent to €108.4 million as the group continued to support the local economy.

By starting to benefit from a more diversified business model and given the improving credit outlook, the group achieved a promising performance in the first half of 2021 as profit before tax was €3.2 million compared to a significant loss last year driven by prudent provisioning to reflect the impact of COVID-19.

MeDirect half-year financial outlook

So far during 2021, MeDirect Group has continued to accelerate its investment programme to build its customer-centric app, combining a broad range of investment services, integrated with daily banking functionality, and expects to launch “exciting” new functionality to its website, mobile app and other customer touchpoints, it says.

The platform has undergone a major transformation over the past two years by leveraging on its unique flexible and scalable technologies, with the goal of delivering best-in-class user experiences to support its mission of making digital investment simple, inclusive and empowering for all the company recounts.

“In the first half of 2021, MeDirect Group maintained steady progress as it achieved strong growth in all those business lines targeted for new investment, resulting in an encouraging profitable performance following 2020 which was a year impacted by significant impairment provisions due to the COVID-19 pandemic,” said Arnaud Denis, Chief Executive Officer of MeDirect Group.

In the first six months of 2021, MeDirect Group continued to implement its balance sheet diversification by actively planning the launch of its future Belgium residential mortgage business line and by successfully launching the home loan business in Malta earlier in 2021.

In addition, the group continued to achieve positive growth in business volumes in jurisdictions in which it operates.

MeDirect Group continued de-risking its international corporate lending portfolio such that, since the beginning of the financial year, the gross size of the portfolio has been reduced by 24 per cent from €903.4 million to €691.1 million and by 46 per cent over the last twelve months.

The gross outstanding balances of the Dutch mortgage book grew by 32 per cent throughout this financial period and as at 30th June 2021 amounted to €1.6 billion. Total funding increased as a result of the funding from the Dutch mortgage securitisation transactions that increased from €348.2 million to 682.6 million.

Mr Denis concluded: “The group’s financial performance improved with lower impairment charges, better capital ratios. Although the outlook for the rest of the year remains challenging, MeDirect continues its accelerated transformation into a leading retail WealthTech banking platform and is working strongly to revert to sustainable profitability in the medium term as we remain disciplined but cautiously optimistic as the economic recovery unfolds.”

Main Image: