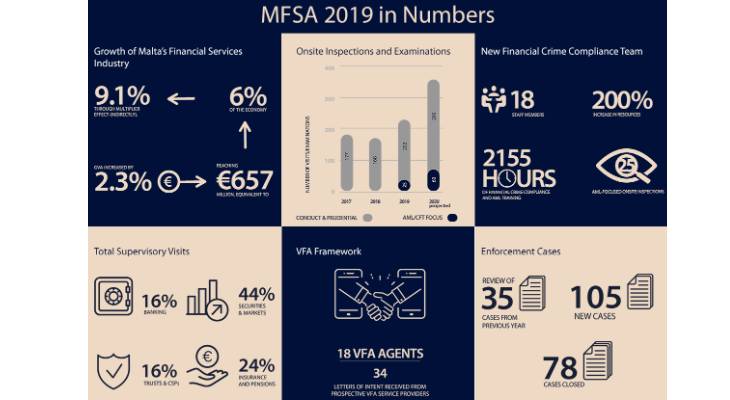

The financial services sector grew by 2.3 per cent in terms of direct Gross Value Added, reaching €657 million and employing 12,230 people last year.

The Malta Financial Services Authority’s annual report shows that 430 new jobs were generated by the sector last year when it represented almost five per cent of total employment.

The indirect effect of financial services is estimated to be between 9 and 10 per cent of GVA.

The MFSA itself generated €11.2 million in 2019 compared to €16.2 million a year earlier. When eliminating the revenue of the Malta Business Registry in 2018, which no longer formed part of the MFSA as of 1st May 2018, the comparative revenue would amount to €11.2 million.

The reason, the financial services watchdog said, was mainly because of lower authorisation fees in 2019, which was compensated for by the introduction of FinTech fees and an increase in authorised listings.

To compensate for the shortfall between the MFSA’s revenue and the operating expenditure, which amounted to €35.2 million, up 46 per cent on 2018, the Government forked out €24.8 million in subventions, representing 69 per cent of the regulator’s annual total income.

Prof John Mamo, MFSA Chairman / mfsa.mt

MFSA Chairman John Mamo noted that the year 2019 was an eventful one for Malta and for the MFSA in particular. “Multiple events highlighted several challenges for our jurisdiction and for the financial services sector, not least those emanating from the threat of global financial crime,” he said.

Prof. Mamo noted that the MFSA made great strides ahead last year, particularly in the development of its vision and strategic framework for 2019-2021 but also in the areas of risk management and the alignment of cross-sectoral priorities into the regulator’s supervisory objectives.

In the year under review, the regulator also developed a detailed corporate governance code which, among other things, strengthens the roles of the risk and audit committees, thus enabling the Board of Governors to exercise its governance responsibilities more effectively, the Chairman said.

Joseph Cuschieri, MFSA CEO / mfsa.mt

An intensification of efforts towards the MFSA’s transformation and development to meet the expectations of international standard setters and the global and jurisdictional challenges to the development and regulation of the financial sector occurred last year, Chief Executive Officer Joseph Cuschieri noted.

The year 2019, he continued, was characterised by a strong ramp-up in the implementation of strategic reforms agreed with the international Monetary Fund and the Committee of Experts on the Evaluation of Anti-Money Laundering Measures and the Financing of Terrorism (MONEYVAL), which also include major efforts in resourcing and investment in upskilling of staff.

“Looking ahead, our priority will be focused on the implementation of the reform programme agreed with the IMF and MONEYVAL but also the challenges created by the COVID-19 outbreak to make sure that the most vulnerable are protected from the financial repercussions of the pandemic but also to ensure that markets keep working well and mitigate any impacts on financial stability. This may impact our attention on other long-term priorities.

“Some of the key reforms in the pipeline include the new capital markets strategy, asset management strategy, the FinTech ecosystem, innovation, banking legislation overhaul, cybersecurity & ICT risk standards and the CSP framework, among other programmes,” Mr Cuschieri said.

Main Image: