EY’s much-anticipated annual attractiveness survey made headlines after it was known that respondents registered a 15 per cent drop in Malta’s overall attractiveness to Foreign Direct Investment (FDI).

A total of 116 current FDI companies of investors responded to EY’s survey, conducted through virtual interviews in June 2020. Some questions were asked again in September 2020.

Beyond the headline figures, WhosWho.mt takes a look at other pertinent points, from adaptations to the crisis to future plans and recruitment. Here are some key takeaways that shed light on Malta’s economic outlook going forward:

Attractiveness – the good news

Malta’s access to the EU market continues to put it in good stead, as does its taxation regime, the English-speaking workforce, the good climate and a strong telecommunications infrastructure. These factors contribute to 83 per cent of manufacturing respondents and 57 per cent of insurance respondents expressing optimism about Malta’s FDI attractiveness.

Meanwhile, FDI investors in Malta appear more upbeat than their counterparts on the continent as regards the post-COVID landscape, with 80 per cent of them saying Malta will be equally or more attractive. Only 51 per cent felt the same about Europe.

Malta’s transport and logistics infrastructure, previously considered Malta’s least attractive FDI parameter, has improved by six percent, although there is a long way to go, as even so, only 25 per cent view it in a positive light.

Attractiveness – the bad news

The good news may sugar coat but cannot completely mask the bitter taste of a 15-percentage point drop in Malta’s attractiveness and a corresponding 10 percentage point increase in respondents saying Malta is not attractive at all. This has been fuelled in large part by the steep drop in the perception of a stable political, legal and regulatory framework, with investors from the banking, insurance, other financial services and iGaming sectors being especially concerned.

“The stability and transparency of Malta’s political, legal and regulatory environment, which, until 2015, ranked in second place with 85 per cent, has seen a sharp decrease of 27 per cent in a single year and now occupies last place on the FDI attractiveness scoreboard with 19 per cent.”

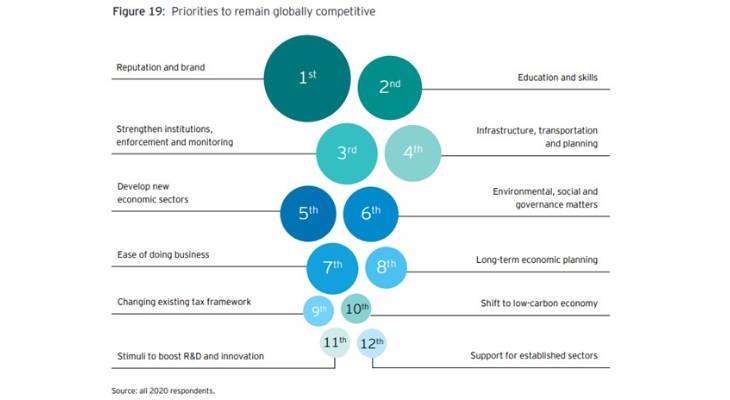

The Council of Europe’s Moneyval assessment was frequently mentioned as a point of concern by respondents from all sectors. Accordingly, the top priority for Malta as identified by foreign investors is shoring up the country’s reputation and brand, with the related strengthening of institutions, enforcement and monitoring also identified as a top priority. The report states that “this result further underlines the country’s need to prioritise tangible reforms that lead to increased trust based on good governance”.

These points sandwich the perennial concern over specialised labour, with respondents continuing to call for more investment in skills and education.

The R&D and innovation environment remains near bottom of the list of parameters, but is also one of the least-highly prioritised areas for further investment.

EY Attractiveness survey 2020

Crisis

Most foreign-owned companies, 57 per cent, said the impact of COVID-19 on their business had been negative so far, with another 21 per cent stating it was positive and the remaining 22 per cent seeing no change.

As expected, the worst hit sector was hospitality, with all (100 per cent) respondents from this sector indicating a negative financial impact. Manufacturing comes in second, with 79 per cent of respondent saying the crisis had hit them badly. The disruption of transportation routes and the closure of ports around the globe is likely the key underlying reason for this. The insurance, iGaming and other financial services sectors were the ones most positively impacted.

Recovery is anticipated to occur within a year for over half of businesses, with the hospitality industry notably being far less optimistic.

As regards 2020 investment plans, half the FDI companies surveyed indicated a delay, decrease or complete cut back. The other half of respondents who said their 2020 investment plans remain unaffected were from the iGaming and insurance sectors.

Astonishingly, over three-quarters of foreign-owned companies implemented remote working, and 99 per cent of these said they adapted quickly to the change. Almost a third (31 per cent) even indicated an increase in productivity, while 53 per cent indicated no change. Over two-thirds intend to adopt remote working for the long term. The report notes that this has positive implications, “including the need to travel less, which reduces traffic, decreases infrastructural demands and benefits the environment”.

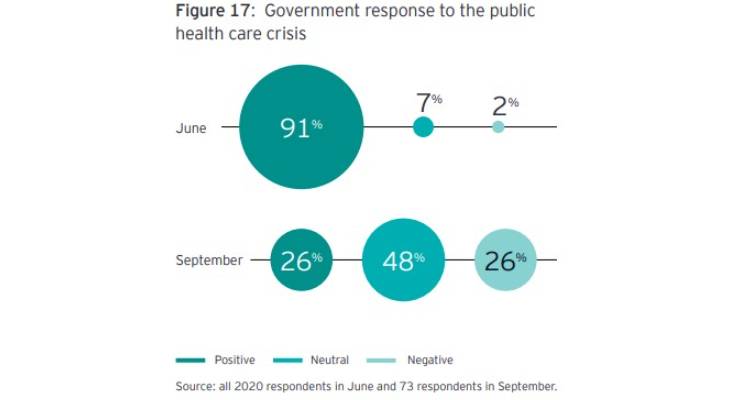

Reactions to the Government’s handling of the pandemic changed drastically between June, when interviews were conducted, and September, when respondents were asked for their views once again.

EY Attractiveness survey 2020

From an overwhelmingly positive view of the strict measures imposed by the Government up until the reopening of the airport, reactions became mixed, with those indicated a negative view rising sharply from only 2 per cent in June to 26 per cent in September.

The response to the support measures provided to companies was more stable, with 61 per cent finding them positive in both June and September.

Recruitment

As the crisis continues to wreak havoc on the economy, half of foreign-owned companies have completely frozen recruitment, with only four per cent having laid off staff, so far. That does not mean the effects were not felt – almost a fifth of companies placed staff on leave, while almost a quarter focused their efforts on upskilling and re-skilling their staff.

On the other hand, the ability to retain specialised staff increased sharply, by 23 per cent in one year, with the report noting that this is “most probably due to employees prioritising job security over job mobility during these uncertain times”.

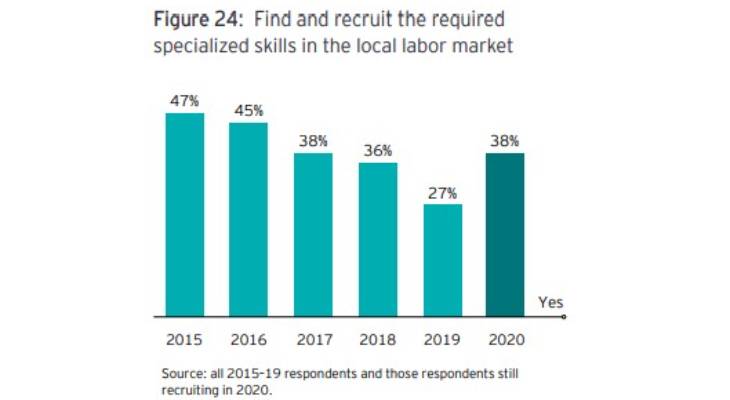

The scarcity of such personnel has continued to weigh on investors’ mind, despite the problem being less acute this year, with 62 per cent of companies continuing to have trouble finding and recruiting the required specialised skills on the local labour market.

EY Attractiveness survey 2020

Expansion

While 80 per cent of foreign-owned companies indicate they expect to be operational in Malta in 10 years’ time, the ones who don’t increased by six percentage points, which the report says “should not be viewed lightly”.

Over half of FDI companies in Malta (53 per cent) were planning to expand prior to the pandemic, although this is nonetheless a five per cent drop from 2019 and a 12 per cent drop from 2018. Hospitality (88 per cent), other financial services (58 per cent) and ICT and telecommunications (56 per cent) were the sectors most prepared to expand their operations. Insurance (71 per cent) and banking (56 per cent) were the most unlikely to do so.

“Following the outbreak, only 66 per cent of respondents could confirm whether their company would pursue its expansion plans.

“Looking at the sectors that initially were most prepared to expand, 57 per cent from hospitality still expect to see their plans through and 57 per cent from other financial services plan to carry them out.

“Although banking and insurance were the sectors with the least intention to expand, all the respondents that did have plans will follow through despite the pandemic. Twenty-one percent of ICT and telecommunications companies and 16 per cent of manufacturing companies with expansion plan have now put them on hold.”

Main Image:EY's Attractiveness survey 2018 conference