The following contribution was penned by Chris Portelli, Chief Technology Officer at MeDirect Bank (Malta) plc.

In 2024, MeDirect achieved remarkable milestones in the field of technology, solidifying its position as a leader in digital banking. By leveraging technology and maintaining a customer-centric approach, MeDirect delivered transformative solutions that significantly enhanced its offerings for both individual and corporate clients.

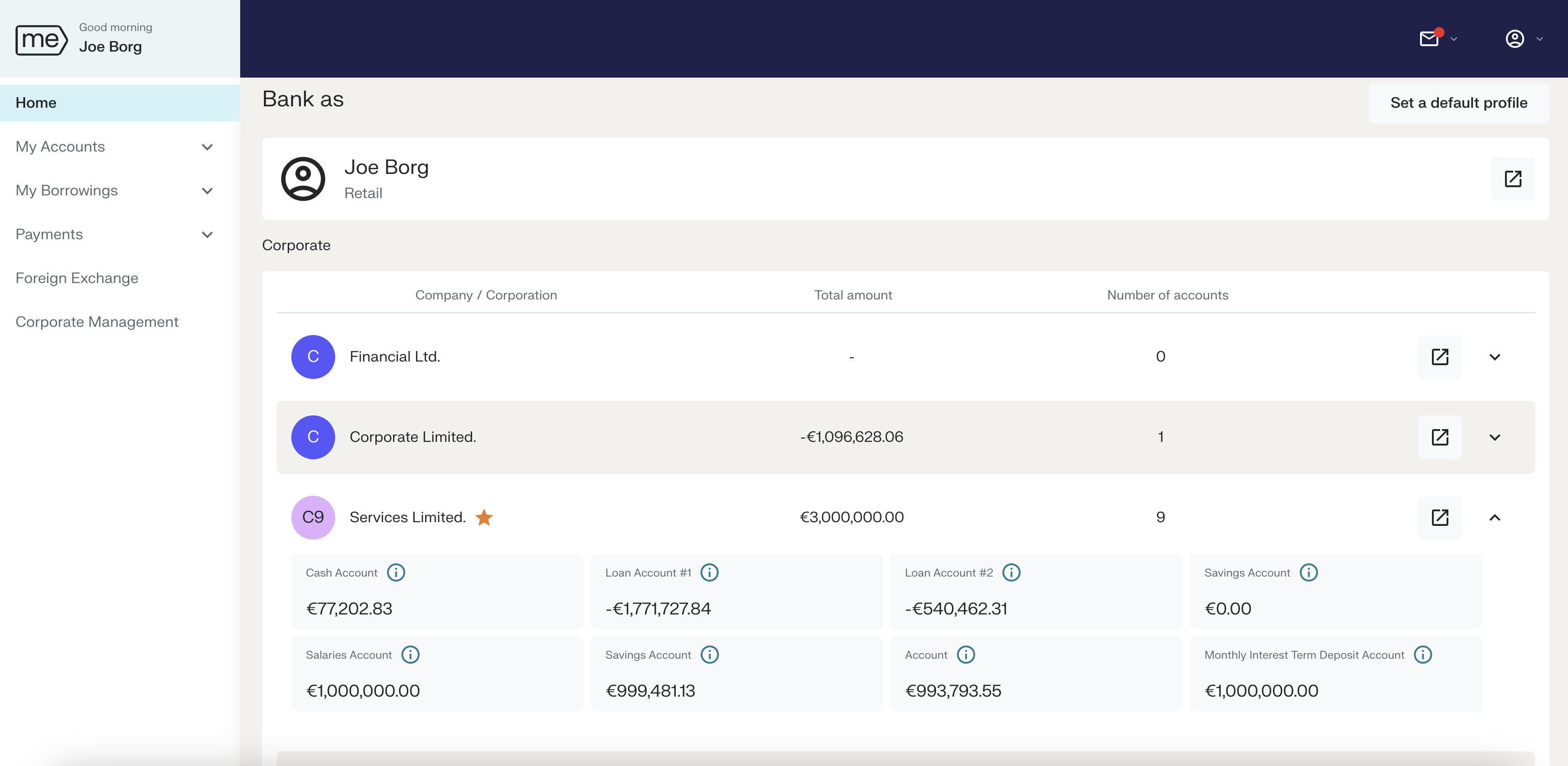

Corporate banking platform

A major highlight of the year was the launch of the MeDirect Corporate Banking Platform, an innovative solution that provides businesses with seamless banking experiences. Among its standout features is a salary payment module, enabling businesses to streamline payroll processes with ease and precision. Built as an omni-channel solution, the platform is accessible through both web and mobile interfaces, ensuring flexibility and convenience for users.

This solution was developed with an emphasis on user-centric design, resulting in highly positive Net Promoter Scores (NPS). Businesses can now manage their corporate and personal accounts through a unified journey, eliminating the need for separate tools and processes. This integration not only saves time but also empowers clients with greater control and visibility over their finances, setting a new benchmark in digital banking solutions.

The corporate services dashboard

Expansion of payment options: Google Pay and Apple Pay

Another key achievement was the rollout of Google Pay and Apple Pay services in Malta and Belgium. These launches followed the introduction of MeDirect’s debit card services, which were successfully implemented just months earlier. By integrating these globally recognised payment platforms, MeDirect has enabled its clients to make secure, contactless payments effortlessly, aligning with the rapidly growing demand for digital payment solutions.

The addition of digital wallets marks a significant step forward in MeDirect’s commitment to delivering modern, tech-driven financial services. These features have not only enhanced convenience but also strengthened the bank’s value proposition in key markets.

A cutting-edge banking ecosystem

Underpinning these advancements is MeDirect’s internally developed banking ecosystem, designed for rapid innovation and scalability. Built with cutting-edge technologies, the platform leverages distributed micro-frontends and microservices architecture, hosted on expansive Kubernetes clusters. This architecture provides MeDirect with unparalleled flexibility to scale its services in response to growing customer demands.

The adoption of distributed micro-frontends ensures that different components of the platform can be updated independently, enabling faster feature releases and a smoother user experience. Similarly, the microservices architecture enhances system resilience and reliability, ensuring uninterrupted service delivery even during peak usage.

By investing in such a robust technological foundation, MeDirect has positioned itself to continuously enrich its offerings and respond dynamically to market needs. This commitment to innovation has not only reinforced client trust but also set the stage for future advancements.

What lies ahead: SEPA instant payments and wealth management

Looking to the future, MeDirect has an ambitious roadmap aimed at further enhancing its services. One of the most anticipated developments is the introduction of SEPA Instant Payments, a feature that will enable real-time euro transfers across participating banks. This will serve as an add-on to MeDirect’s internally built payment hub, providing clients with faster and more efficient payment capabilities.

Another exciting project in the pipeline focuses on wealth management. MeDirect is exploring an open model that will allow clients to invest in model portfolios tailored to their financial goals. This innovative solution aims to simplify wealth management, making it more accessible and user-friendly for clients seeking to grow their investments.

A commitment to continuous evolution

Beyond these initiatives, MeDirect remains dedicated to evolving its platform with additional features and functionalities designed to make money and wealth management as effortless as possible. By listening to client feedback and staying ahead of industry trends, the bank is committed to delivering solutions that cater to the evolving needs of its diverse customer base.

In summary, 2024 has been a transformative year for MeDirect. From the launch of an omni-channel corporate banking platform to the introduction of globally recognised payment solutions, the bank has consistently demonstrated its ability to innovate and adapt. Supported by a cutting-edge technological infrastructure, MeDirect is well-positioned to continue its trajectory of growth and innovation, shaping the future of digital banking for years to come.

This is a marketing communication from MeDirect Bank (Malta) plc

MeDirect Bank (Malta) plc, company registration number C34125, is regulated by the Malta Financial Services Authority and is licensed to undertake the business of banking in terms of the Banking Act (Cap. 371) and investment services under the Investment Services Act (Cap. 370).

MeDirect Bank (Malta) plc is regulated by the Malta Financial Services Authority as a Credit Institution under the Banking Act 1994.

MeDirect Bank (Malta) plc, The Centre, Tigné Point, Sliema, TPO 0001, Malta.